Reflecting climate-related goals in an ETF portfolio

KEY POINTS

For ETF investors looking to reflect the climate-related goals in their portfolios, funds that follow indexes such as the Paris-Aligned Benchmark offer a potential solution.

Identifying ETF that can demonstrate carbon emission criteria clearly has not been a straightforward task. While benchmarks exist for comparing impact portfolios such as green and social bonds, it has been challenging to find a reference point for a conventional portfolio designed to support the transition to a low carbon economy.

This is where benchmarks such as the Paris-Aligned benchmarks (PABs) and the Climate Transition benchmarks (CTBs) offer an option for investors. These benchmarks assess companies’ contributions to the transition to a low-carbon economy. While both PAB and CTB share a similar focus on decarbonisation with an annual 7% target on carbon reduction, there are key differences between the two:

- The Paris-Aligned Benchmark (PAB) aims to achieve alignment with the 1.5°C goal of the Paris Agreement so excludes fossil-fuel intensive companies.

- The CTBs focus on transitioning to a low-carbon economy rather than just limiting global warming.

- PAB requires a more aggressive 50% minimum carbon reduction relative to the market index, as compared to the 30% reduction required for the CTB approach.

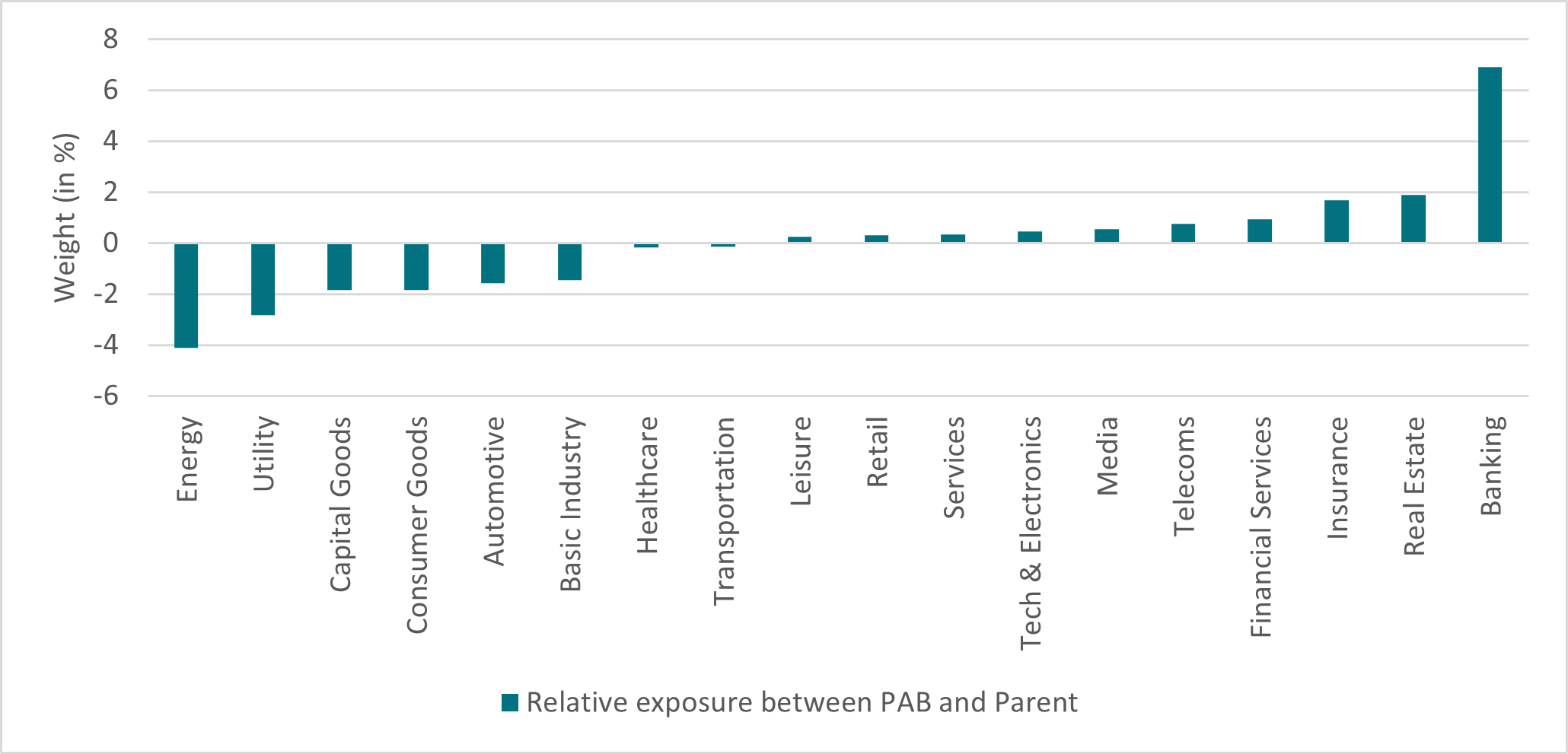

The PAB is designed to align with climate goals, typically emphasising sectors and issuers that contribute positively to decarbonisation efforts. It, therefore, has a slightly higher weighting to lower carbon intensity sectors such as Banks, Insurance, Real Estate and Telecoms. On the other hand, it has less exposure than its parent index to other sectors that are highly carbon intensive such as Energy, Utilities and Basic Industry.

This approach goes beyond blanket exclusions and instead has a focus on positive screening. In doing so, the benchmark aims to help fund the transition to a sustainable economy while encouraging issuers in more pollutant sectors to develop more sustainable practises.

Nevertheless, as the chart below demonstrates, the sector weighting differences between the PAB and its parent index remains limited.

Sector relative exposure

Source: AXA-IM, Bloomberg, as of 25/03/2024. Indices compared: Parent: ICE BofA Euro Corporate Index and PAB: ICE BofA Euro Corporate Index Paris Aligned (Absolute Emissions)

Is there a trade-off for a climate aware approach?

The role of a climate index is to closely track its parent index while sifting out issuers that don’t meet the emission requirements. Therefore, the climate index will have less issues than its parent index, although it still maintains sufficient diversity and liquidity.

Historically, funds looking to reflect decarbonisation in their portfolios would use a standard benchmark and then exclude certain sectors. This led to higher tracking errors because the exclusions meant a more concentrated portfolio. Being able to use a benchmark specifically designed to reflect companies that are contributing towards the decarbonisation should mean that the fund’s tracking error is much lower.

When comparing the ICE BofA Euro Credit Paris Aligned (Absolute Emissions) index with its parent index, they both have similar credit risk profiles with each currently offering an average credit rating of A-1.

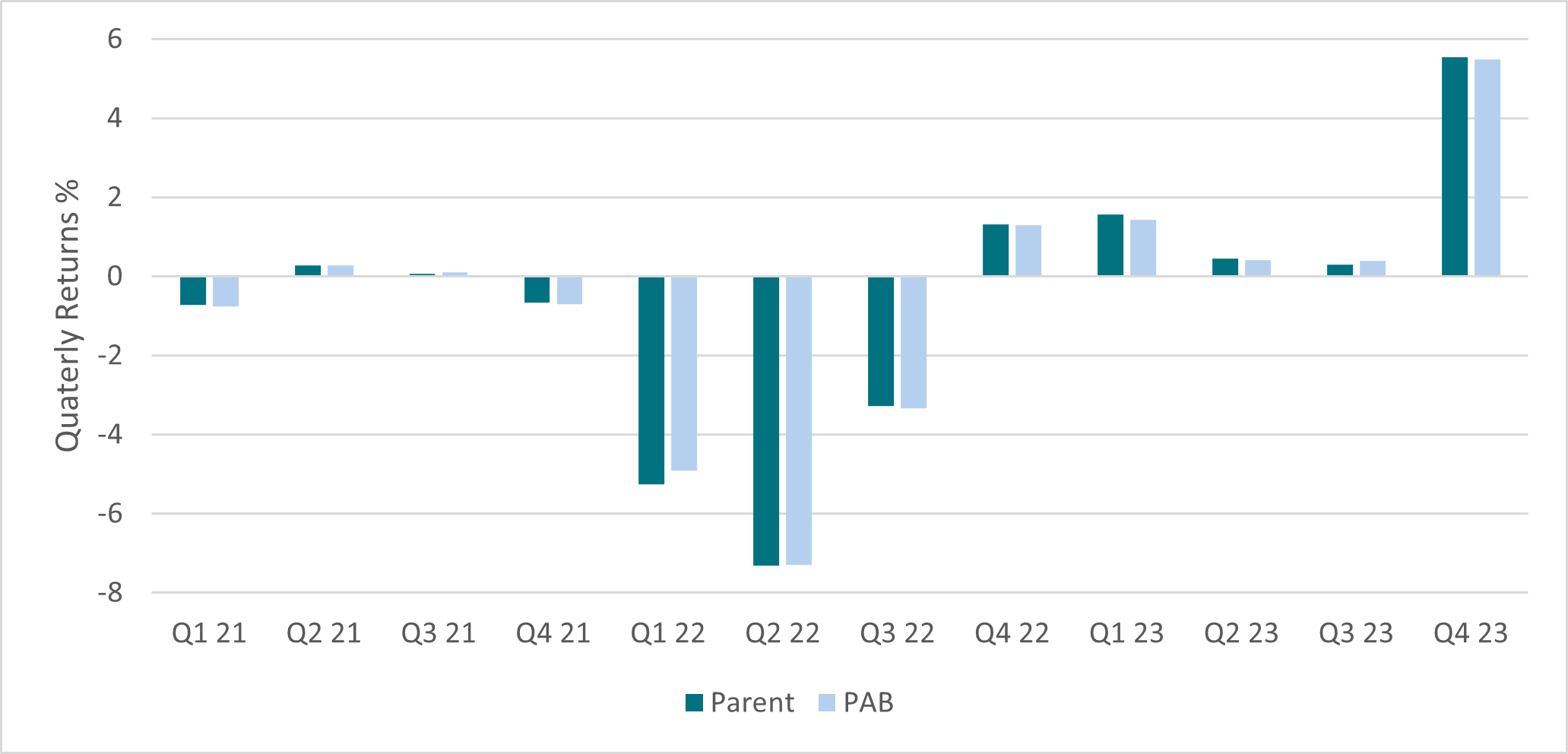

Furthermore, the performance in 2021, 2022 and 2023 was relatively closely correlated. While the data is still limited for comparison given that the PAB was only launched in 2021, these initial years demonstrate that it is possible to not give up returns for sustainable investing, as illustrated in the chart below:

Return for Parent and PAB indices

Source: AXA-IM, Bloomberg, as of 25/03/2024. Indices compared: Parent: ICE BofA Euro Corporate Index and PAB: ICE BofA Euro Corporate Index Paris Aligned (Absolute Emissions)

Indexes like PAB and CTB offer investors a solution that allows them to reflect their climate-related goals without having to accept a higher tracking error or more concentrated portfolio.

- Source: AXA IM, Bloomberg as of 03 April 2024

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia Limited (“AXA IM HK”), an entity licensed by the Securities and Futures Commission of Hong Kong (“SFC”), for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy, sell or enter into any transactions in respect of any investments, products or services, and should not be considered as solicitation or investment, legal, tax or any other advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities under any applicable law or regulation. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation, investment knowledge or particular needs of any particular person and may be subject to change at any time without notice. Offering may be made only on the basis of the information disclosed in the relevant offering documents. Please consult independent financial or other professional advisers if you are unsure about any information contained herein.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee such opinions, estimates and forecasts made will come to pass. Actual results of operations and achievements may differ materially. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Information herein may be obtained from sources believed to be reliable. AXA IM HK has reasonable belief that such information is accurate, complete and up-to-date. To the maximum extent permitted by law, AXA IM HK, its affiliates, directors, officers or employees take no responsibility for the data provided by third party, including the accuracy of such data. This material does not contain sufficient information to support an investment decision. References to companies (if any) are for illustrative purposes only and should not be viewed as investment recommendations or solicitations.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and that past performance is no guarantee of future returns, investors may not get back the amount originally invested. Investors should not make any investment decision based on this material alone.

Some of the services listed on this Website may not be available for offer to retail investors.

This Website has not been reviewed by the SFC. © 2025 AXA Investment Managers. All rights reserved.